San Mateo Property Appraiser

Assessor - San Mateo County Clerk

The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. ... 2026 County of San Mateo. All ...

https://smcacre.gov/assessorProperty Tax Look-up - Assessor - San Mateo County Clerk

County of San Mateo's Treasurer-Tax Collector offers a Secured Property Tax Search ... 2026 County of San Mateo. All rights reserved. Jump back to ...

https://smcacre.gov/assessor/property-tax-lookProperty Tax Rate Book County of San Mateo, CA

Need Help? These publications are in PDF format. To view PDF documents you must have Adobe Reader installed on your computer. You can download Adobe Reader for free from the Adobe website. If you have questions, please contact Nathan Gee at (650) 599-1141 or [email protected].

https://www.smcgov.org/controller/property-tax-rate-book

TOP 10 BEST Property Appraiser in San Mateo, CA

... Appraiser" results near me in San Mateo, California - January 2026. Showing 1-60 of 172. GHI Appraisal Service - Property Appraiser near me - San Mateo, ...

https://www.yelp.com/search?find_desc=Property+Appraiser&find_loc=San+Mateo%2C+CASan Mateo County's 2025-26 Local Assessment Roll Reaches ...

Approximately 1% of the assessed roll supports the County's property tax base, equating to $3.41 billion in revenue. ... 2026 County ...

https://smcacre.gov/assessor/news/san-mateo-countys-2025-26-local-assessment-roll-reaches-record-high-after-15thCAA e-Forms Service Center - San Mateo: BOE-266

Got questions about forms? Please visit our FAQ page or click on your county’s page for contact information. This site is updated at least annually. Forms for use in 2027 will be available starting January 1st, 2027. This is a California Counties and BOE website.

https://www.capropeforms.org/counties/san_mateo/form/BOE-266/2026

Salary: Property Appraiser in San Mateo, CA (Jan, 2026)

The average PROPERTY APPRAISER SALARY in San Mateo, CA, as of January 2026, is $30.06 an hour or $62530 per year. Get paid what you're worth! Explore now.

https://www.ziprecruiter.com/Salaries/Property-Appraiser-Salary-in-San-Mateo,CAMeasure A - 2026-2027 Parcel Tax Exemption Application

Measure A - 2026-2027 Parcel Tax Exemption Application The exemption deadline for Measure A for the 2025-2026 Tax Roll was June 30, 2025. (Applications are no longer being accepted) The exemption deadline for Measure A for the 2026-2027 Tax Roll is June 30, 2026.

https://www.millbraeschooldistrict.org/community/parcel-tax/measure-a-2026-2027-parcel-tax-exemption-application

Assessment Appeals Board County of San Mateo, CA

The Role of the Assessment Appeals Board The AAB can only review individual assessments at the hearing brought to its attention by the Assessment Appeals process and only has the authority to determine the value of the property as it existed either on January 1st (the lien date), on the date of a change in ownership, upon completion of new construction, or on the date of a disaster or calamity.

https://www.smcgov.org/ceo/assessment-appeals-board

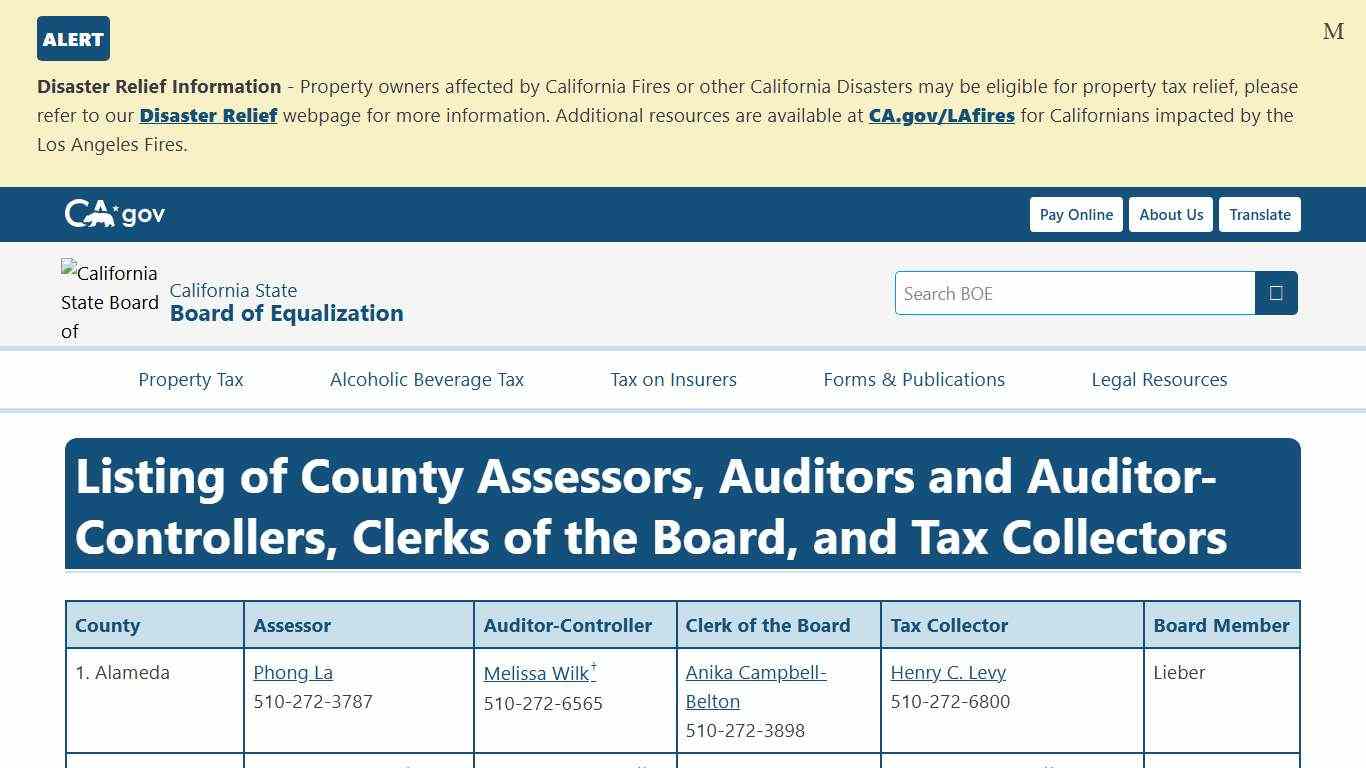

Listing of County Assessors, Auditors and Auditor-Controllers, Clerks of the Board, and Tax Collectors

Alert from California State Board of Equalization...

https://boe.ca.gov/proptaxes/countycontacts.htm

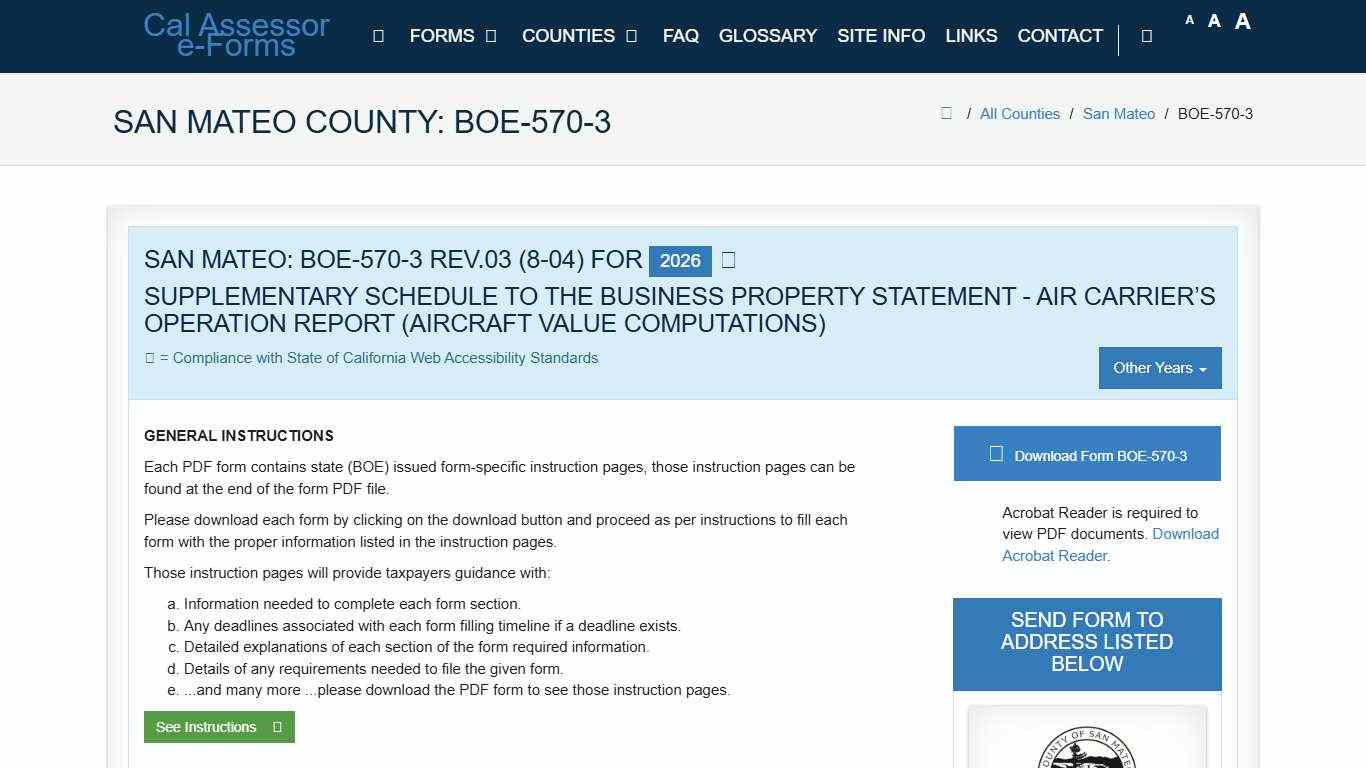

CAA e-Forms Service Center - San Mateo: BOE-570-3

Got questions about forms? Please visit our FAQ page or click on your county’s page for contact information. This site is updated at least annually. Forms for use in 2027 will be available starting January 1st, 2027. This is a California Counties and BOE website.

https://www.capropeforms.org/counties/san_mateo/form/BOE-570-3/2026

San Mateo eyes sales tax Local News smdailyjournal.com

The city of San Mateo is exploring a sales tax measure this November, citing long-term structural deficits that could start impeding basic city services and infrastructure needs. The city is already facing a $14 million projected deficit this fiscal year, which ends in June, and a continuous shortfall in the future.

https://www.smdailyjournal.com/news/local/san-mateo-eyes-sales-tax/article_079f6c81-e5b3-4b34-9768-6891074400a2.html

Property Taxes by State and County, 2025 Tax Foundation Maps

Property taxes are the primary tool for financing local governments. In fiscal year 2022, property taxes comprised 27.4 percent of total state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

https://taxfoundation.org/data/all/state/property-taxes-by-state-county/

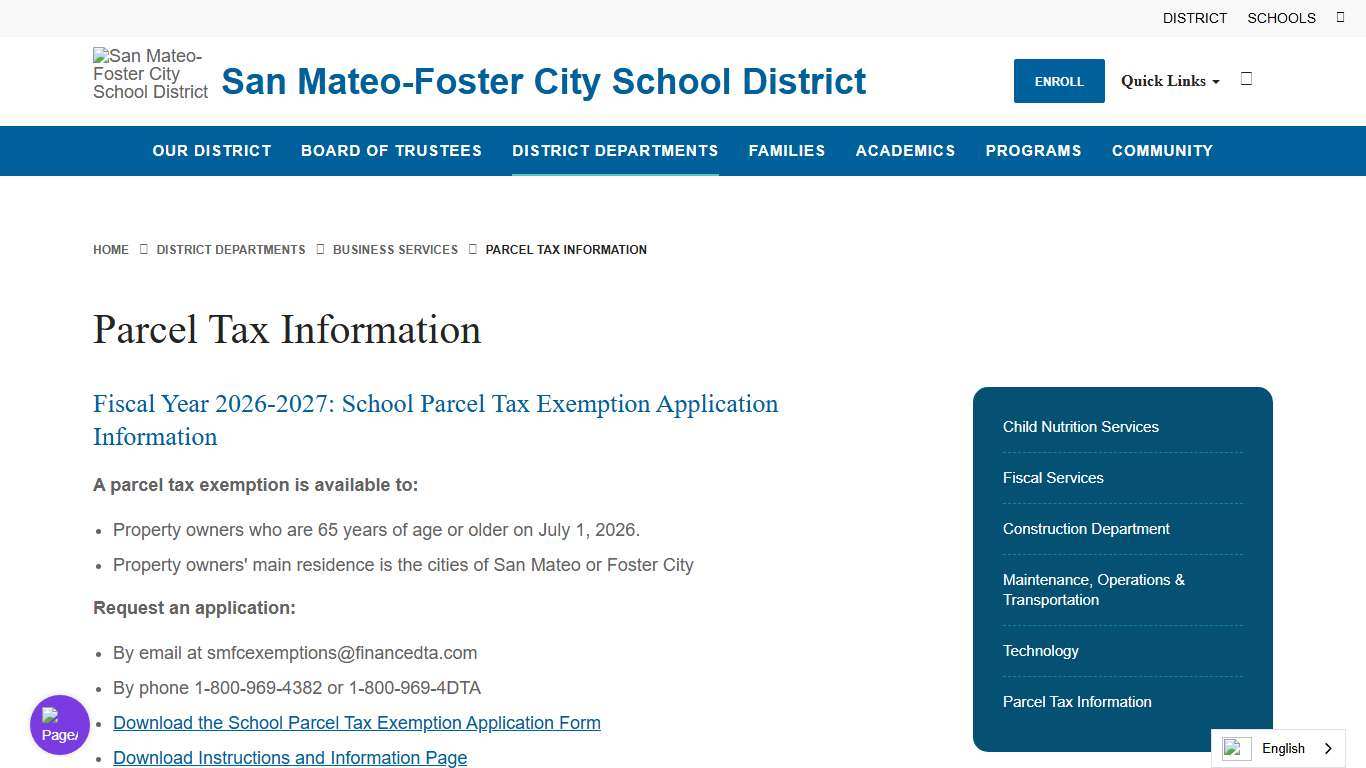

Parcel Tax Information - San Mateo-Foster City School District

Parcel Tax Information Fiscal Year 2026-2027: School Parcel Tax Exemption Application Information A parcel tax exemption is available to: - Property owners who are 65 years of age or older on July 1, 2026. - Property owners' main residence is the cities of San Mateo or Foster City Request an application: - By email at [email protected] - By phone 1-800-969-4382 or 1-800-969-4DTA...

https://www.smfcsd.net/district-departments/business-services/parcel-tax-information

Andersen

Tailored, Borderless Solutions, Seamlessly Integrated. Andersen delivers customized tax, valuation, and financial advisory solutions on an unmatched global platform to support individuals, families, businesses, and funds through every stage of growth. Learn MoreTax Transformation & Innovation Combining deep tax knowledge with advanced technology and process innovation, Andersen’s newest practice delivers solutions that drive efficiency, reduce...

https://andersen.com/

2026 Frs, California Sales Tax Calculator & Rate – Avalara

San Mateo sales tax details The minimum combined 2026 sales tax rate for San Mateo, California is 9.63%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%. The San Mateo sales tax rate is 0.25%.

https://www.avalara.com/taxrates/en/state-rates/california/cities/frs.html